openerp-community team mailing list archive

-

openerp-community team

openerp-community team

-

Mailing list archive

-

Message #05933

Re: Multiple fiscal positions on partners

*Marcelo*

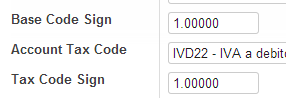

I just noticed, that probably this might help in declaring another amount

than our invoicing:

[image: Inline-Bild 1]

here you can say which percentage of the invoiced tax should go on the

respective tax account... From which reporting could be done.

*Best,* David

----------------------

*David Arnold B.A. HSG*

*Gerente*

+57 315 304 1368

david@xxxxxxxxxxx

www.elaleman.co

El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

2014-06-02 20:09 GMT-05:00 David Arnold - El Alemán <david@xxxxxxxxxxx>:

> *Lorenzo Battistini*

>

> could you drop some comments on this from an italian perspective? I hope

> to fetch best practices from around the world!

> I've seen you've done quite a bit of coding in your localization, but on

> the other hand there are some modules rediliy available...

>

> - Fiscal Classification

> - Fiscal Position

> - Fiscal Position Rule

>

> Whith some amendemnds this could serve your case quite generically... But

> maybe we're missing something.

>

> *Mille Grazie*

>

> David

>

>

> ----------------------

> *David Arnold B.A. HSG*

> *Gerente*

>

> +57 315 304 1368

> david@xxxxxxxxxxx

> www.elaleman.co

>

> El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

>

>

> 2014-06-02 14:01 GMT-05:00 David Arnold - El Alemán <david@xxxxxxxxxxx>:

>

> +1 for gustavo... Let's not be sheeps.. ;) (http://goo.gl/UISRs5)

>>

>>

>> ----------------------

>> *David Arnold B.A. HSG*

>> *Gerente*

>>

>> +57 315 304 1368

>> david@xxxxxxxxxxx

>> www.elaleman.co

>>

>> El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

>>

>>

>> 2014-06-02 13:07 GMT-05:00 Gustavo Adrian Marino <gamarino@xxxxxxxxx>:

>>

>> I hope that what Odoo is going to present is the start of a community

>>> discussion and not as usual what they decided we should think.

>>>

>>> We know how hard is to adapt the vision of OpenERP to the real needs we

>>> face in our markets. Even if what they propose as new features is aligned

>>> with our needs, v9 means we are talking about something 12/18 months ahead.

>>> It is too far away for any real solution.

>>>

>>> We already know what to expect from OpenERP S.A. and v8. Let's work to

>>> make our work a little bit easier. Do not expect too much from Odoo.

>>>

>>> A common criteria on taxes treatment is a desirable goal, and something

>>> it could save us real work.

>>>

>>> Best regards

>>>

>>> Gustavo Adrian Marino

>>>

>>> Mobile: +54 911 5498 2515

>>>

>>> Email: gamarino@xxxxxxxxx

>>>

>>> Skype: gustavo.adrian.marino

>>>

>>>

>>>

>>>

>>>

>>>

>>> 2014-06-02 14:42 GMT-03:00 David Arnold - El Alemán <david@xxxxxxxxxxx>:

>>>

>>> So *please, anyone, *tag this conversation as relevant for such

>>>> talks!!!! ;)

>>>>

>>>>

>>>> ----------------------

>>>> *David Arnold B.A. HSG*

>>>> *Gerente*

>>>>

>>>> +57 315 304 1368

>>>> david@xxxxxxxxxxx

>>>> www.elaleman.co

>>>>

>>>> El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

>>>>

>>>>

>>>> 2014-06-02 12:09 GMT-05:00 Marcelo Bello <marcelo.bello@xxxxxxxxx>:

>>>>

>>>> David, just a heads up, there is a focus on accounting and changes to

>>>>> allow for greater tax flexibility for v9, I think on OpenDays there will be

>>>>> a talk just on that. May be good to get to know how SA is thinking about

>>>>> this.

>>>>> On 2 Jun 2014 12:54, "David Arnold - El Alemán" <david@xxxxxxxxxxx>

>>>>> wrote:

>>>>>

>>>>>> To sum it up in a kind of to do list for Colombia tax project

>>>>>> (containing additional items):

>>>>>>

>>>>>> - widen concept of fiscal position to be allocation (and not only

>>>>>> replacement tables)

>>>>>> - allow for n allocation tables, n product attributes and n partner

>>>>>> attributes (ideally grouped around tax domains), which steer behaviour of

>>>>>> fiscal position roules (tax controller)

>>>>>> - reframe fiscal classification to match the requirements of being a

>>>>>> n product attribute

>>>>>> - prepare for generic granularity (now via individual XML reports) -

>>>>>> > maybe pentaho integration

>>>>>> - allow tax precision be independent of account precision (blame

>>>>>> OpenERP SA R&D for not being able to solve this since 2011 despite several

>>>>>> bug reports and fierce discussion)

>>>>>> - allow tax chart queries for an individualized set of periods (not

>>>>>> just one) - in case reporting periods differ on different concepts

>>>>>>

>>>>>> Anything to add? Further comments?

>>>>>>

>>>>>> *Best,* David

>>>>>>

>>>>>>

>>>>>> ----------------------

>>>>>> *David Arnold B.A. HSG*

>>>>>> *Gerente*

>>>>>>

>>>>>> +57 315 304 1368

>>>>>> david@xxxxxxxxxxx

>>>>>> www.elaleman.co

>>>>>>

>>>>>> El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

>>>>>>

>>>>>>

>>>>>> 2014-06-02 10:32 GMT-05:00 David Arnold - El Alemán <

>>>>>> david@xxxxxxxxxxx>:

>>>>>>

>>>>>>> *Hello Marcelo, Hello Gustavo*

>>>>>>>

>>>>>>> I hope that at least during World Championship, Brazilian

>>>>>>> accountants might find some spare time to watch some games... ;)

>>>>>>>

>>>>>>> I think the kind of flexibilzation proposed, could get you

>>>>>>> generically covered on everything which are attributes of partners and

>>>>>>> products. It is true that the invoice line itself, in other words: the

>>>>>>> specific characteristics of a particular sale (which are not attributed to

>>>>>>> partner or product) are somewhat difficult.

>>>>>>>

>>>>>>> The Tax Include /Base Amount Include topic I also noticed. The *Core

>>>>>>> here seems utterly buggy *afaik, Akretion completely overwrote it

>>>>>>> to make it somewhat intelligent. See a pull request, i made

>>>>>>> recently: https://github.com/odoo/odoo/pull/219

>>>>>>> (I think I'm not the first one to notice, that bugs/pull requests

>>>>>>> are handled very inefficiently at the moment? A perceived lack of

>>>>>>> respect. Other projects do that way better. Hint!)

>>>>>>>

>>>>>>> I got the AHA moments. ;) I think probably the tax break logic can

>>>>>>> be kind of a generic use case. In some countries of the world, there are a

>>>>>>> lot of Free Trade Zones and probably special tax brakes. But I'm not sure,

>>>>>>> if this should be calculated on the invoice or even line-item

>>>>>>> granularity. My best guess is rather that it is more appropriate to account

>>>>>>> for such situation at an accounting level.

>>>>>>>

>>>>>>> As to *Argentina* it seems, the that tax system is very parallel to

>>>>>>> the Colombian one. I'm not sure about the "activity", because in fact this

>>>>>>> is kind of an aggregate product classification. In case of Colombia

>>>>>>> we are talking about CIIU (ISIC: http://unstats.un.org/unsd/cr

>>>>>>> /registry/isic-4.asp), which can be mapped for example to product

>>>>>>> classification CPC (http://unstats.un.org/unsd/cr/registry/regcst.asp?Cl=25&Lg=1).

>>>>>>> So in fact "activity" refers to kind of a simplified product

>>>>>>> classification, which is trying to cover the standard case, where

>>>>>>> one company is dedicated to one or few activities. But caution! A

>>>>>>> company can pursue multiple activities depending on the specific

>>>>>>> product it is producing. So this way, the CIIU is a *product *

>>>>>>> attribute.

>>>>>>>

>>>>>>> I think as to the base done, we have great modules like Fiscal

>>>>>>> Classification and Fiscal Position Rule available, however these

>>>>>>> must be altered, to reflect an adaptable high level logic. (The ones

>>>>>>> mentioned by Pedro and Raphael) Fiscal Position Rule already allows

>>>>>>> for a logic depending on State, Country (all three: Issuer Address,

>>>>>>> Delivery or Invoice Address) But what it does lack is to account

>>>>>>> for other fiscal attributes of the partner and the product.

>>>>>>>

>>>>>>> On the partner side, there can be applied for example in the case of

>>>>>>> the domain of a specific national tax a *retention *depending on

>>>>>>> issuer *and * buyer characteristics. This actually is not an

>>>>>>> available attribute in Fiscal Position Rule. On the other Hand, *fiscal

>>>>>>> classification * is a module to provide tax-sets on products. If we

>>>>>>> dismantle this concept, it comprises a classification + an actual

>>>>>>> allocation (two in one). Additionally, it is single-dimension. So there is

>>>>>>> only one possible classification available at the moment.

>>>>>>>

>>>>>>> The Brazilian localization from Akretion (credits!) tackle this

>>>>>>> issues in a very country specific and "hard coded" way. But it's readily

>>>>>>> available for *"genericalization" *If you think then the Fiscal

>>>>>>> Position module as an extensible controller logic, you probably could cover

>>>>>>> all Argentinian/Venezuelan/etc. tax cases.

>>>>>>>

>>>>>>> Such a common framework would then also be easier to adapt at those

>>>>>>> Brazilian specialties (such that line order attributes are

>>>>>>> important).

>>>>>>>

>>>>>>> I value your ideas, of abstracting taxes further. Actually when

>>>>>>> having dinner yesterday with the localization team we ran about the idea of

>>>>>>> an completely independent tax enginge with an API to provide for

>>>>>>> south America's ERP, to outsource the headache of tax calculation

>>>>>>> to a central company. (Hint for smart entrepreneurs!) There are some US

>>>>>>> companies for a possible exit strategy on such a project. I think, such

>>>>>>> ideas are probably outside the focus of OpenERP (I know, the

>>>>>>> culture is somewhat let's copy/reinvent the wheel in some cases, but you

>>>>>>> probably already know my opinion on that).

>>>>>>>

>>>>>>> However some aspects, I see, can be covered by the localization

>>>>>>> *templates* (not the updating aspect). You can define tax accounts

>>>>>>> on the general ledger an allocate taxes to, etc. To abstract this, I'm not

>>>>>>> sure, if that wouldn't be too specific, as you would have map your accounts

>>>>>>> to a set of tax-concepts (kind of tax api), but this set of concepts can be

>>>>>>> very dynamic as per jurisdiction. So this mapping effort would have to be

>>>>>>> done also in case of an update in the mapping structure.

>>>>>>>

>>>>>>> A side note on aggregating granularity to obtain tax statements: I

>>>>>>> think that the Odoo way of displaying taxes (Chart of Taxes will in

>>>>>>> the near future become deprecated as concepts such as XBRL (

>>>>>>> http://es.wikipedia.org/wiki/XBRL) win ground. Basicially you take

>>>>>>> a xml-tag of the official or national "taxonomy", then you define

>>>>>>> which data has to be aggregated around that specific tag, then you file via

>>>>>>> XML to your authorities) This granularity approach will certainly be

>>>>>>> necessary for a lot of countries (also for statistical reporting,

>>>>>>> which can be tied to taxes or not). So I think at least we wouldn't have to

>>>>>>> bother to much about in which tax account to strategically allocate a tax

>>>>>>> perspectively. (Maybe the whole concept of tax accounts will get

>>>>>>> deprecated, as granularity advances, as it's basically replicated

>>>>>>> information and a violation of the DRY principle)

>>>>>>>

>>>>>>> I think, it would be very helpful if you could publish your code on

>>>>>>> github, in order to be able to analyze it and look for parallel

>>>>>>> concepts. Maybe the multicompany-management approach can be

>>>>>>> refactored as a compatible delta module in the future?

>>>>>>>

>>>>>>> The Colombian one lives at: https://github.com/odoo-colombia/odoo-

>>>>>>> colombia

>>>>>>>

>>>>>>> @ Ana: Europe gratefully in't the sad standard of tax complexity.

>>>>>>> The only tax retention to be known in Germany is in construction (as a

>>>>>>> sector which has a lot of tax evasion).

>>>>>>>

>>>>>>> *Best,* David

>>>>>>>

>>>>>>>

>>>>>>> ----------------------

>>>>>>> *David Arnold B.A. HSG*

>>>>>>> *Gerente*

>>>>>>>

>>>>>>> +57 315 304 1368

>>>>>>> david@xxxxxxxxxxx

>>>>>>> www.elaleman.co

>>>>>>>

>>>>>>> El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

>>>>>>>

>>>>>>>

>>>>>>> 2014-06-02 9:11 GMT-05:00 Gustavo Adrian Marino <gamarino@xxxxxxxxx>

>>>>>>> :

>>>>>>>

>>>>>>> Let me add some considerations for Argentina: In our country is very

>>>>>>>> clear that the taxes to be applied are dependant on:

>>>>>>>>

>>>>>>>> - The issuer company, and the possibility to act as a retention

>>>>>>>> agent for some taxes

>>>>>>>> - The issuer activity

>>>>>>>> - The fiscal address: one set of taxes could be potentially

>>>>>>>> applied based on city, federal state and country

>>>>>>>> - The product

>>>>>>>> - The buyers activity

>>>>>>>> - The buyers fiscal address

>>>>>>>>

>>>>>>>> If you are trying to define a new way to treat taxes, for sure the

>>>>>>>> idea of redefining the tax structure per company (as today in Odoo) and

>>>>>>>> "fixing" via a simple table is simply not reflecting reality nor the common

>>>>>>>> use pattern of any real customer

>>>>>>>>

>>>>>>>> I have started developing a module to redefine taxes accounts as

>>>>>>>> properties per company and assigning a set of taxes to federal states and

>>>>>>>> countries. This set of taxes should be applied depending on issuing

>>>>>>>> companies fiscal federal_state and country.

>>>>>>>>

>>>>>>>> This arrangement allows us to deliver an incremental set of taxes

>>>>>>>> covering first the country level and then federal state taxes as needed.

>>>>>>>> This taxes could be configured AFTER the company account plan is set for

>>>>>>>> the company set needed, and thus allowing to adapt the DB to changes in

>>>>>>>> taxes without having to do manual editing on every company in the database.

>>>>>>>>

>>>>>>>> Of course a set of company specific taxes is also provided

>>>>>>>>

>>>>>>>> Additionally, due to the fact now taxes are global (not company

>>>>>>>> specific), you can define taxes on products without be worried to point to

>>>>>>>> the exact account on each company, and avoiding to rely on obscure access

>>>>>>>> rules to manage taxes.

>>>>>>>>

>>>>>>>> Under the new scenario, accounts could be only visible to the

>>>>>>>> company they are defined on, reflecting the fact they are strongly tied to

>>>>>>>> company's account plan.

>>>>>>>>

>>>>>>>> Under this schema, the need of fiscal positions for customers is

>>>>>>>> strongly reduced to some simple cases, reflecting just special cases for

>>>>>>>> some customers, and thus using the simple standard approach is enough in

>>>>>>>> most cases.

>>>>>>>>

>>>>>>>> The module is still not in production. If you think this approach

>>>>>>>> could be used as a common strategy, I have no problem publishing it

>>>>>>>>

>>>>>>>> Best regards

>>>>>>>>

>>>>>>>>

>>>>>>>>

>>>>>>>> Gustavo Adrian Marino

>>>>>>>>

>>>>>>>> Mobile: +54 911 5498 2515

>>>>>>>>

>>>>>>>> Email: gamarino@xxxxxxxxx

>>>>>>>>

>>>>>>>> Skype: gustavo.adrian.marino

>>>>>>>>

>>>>>>>>

>>>>>>>>

>>>>>>>>

>>>>>>>>

>>>>>>>>

>>>>>>>> 2014-06-02 10:14 GMT-03:00 Marcelo Bello <marcelo.bello@xxxxxxxxx>:

>>>>>>>>

>>>>>>>> David, my 2cents as an user of the Brazilian localization (I am not

>>>>>>>>> aware of all the technical challenges, I am just speaking from an end user

>>>>>>>>> PoV).

>>>>>>>>>

>>>>>>>>> The idea of an application instead of replacement table sounds

>>>>>>>>> good to me. Usability-wise I always found strange that by default a product

>>>>>>>>> would have dozens of taxes pre-applied to it only for most to be filtered

>>>>>>>>> out later in the process. Again, I am sure there are design decisions to

>>>>>>>>> justify that, but usability-wise it is not ideal.

>>>>>>>>>

>>>>>>>>> Regarding what you say about the flexibility of the current

>>>>>>>>> implementation, I agree with you that some pieces might be missing, but at

>>>>>>>>> least in the context of the Brazilian tax legislation what you propose will

>>>>>>>>> still not cover the full range of possibilities that need to be taken into

>>>>>>>>> account.

>>>>>>>>>

>>>>>>>>> At least in the case of Brazil, the taxation of a sale needs

>>>>>>>>> to take into account information from:

>>>>>>>>>

>>>>>>>>> - The buyer/partner;

>>>>>>>>>

>>>>>>>>> - The product itself;

>>>>>>>>>

>>>>>>>>> - The seller (the company selling, in the case of a company with

>>>>>>>>> multiple branches - like my company - this is extremely relevant because

>>>>>>>>> some of my branches are on special trade zones which change the tax

>>>>>>>>> calculation significantly);

>>>>>>>>>

>>>>>>>>> *- The order.line: *for example, a product in Brazil is taxed

>>>>>>>>> differently depending on whether the buyer plans to resell the item or if

>>>>>>>>> it is going to consume it (or add it to its assets).

>>>>>>>>>

>>>>>>>>> *- The product unit being sold* - yes, some pieces of legislation

>>>>>>>>> requires us in Brazil to keep track of individual units so that they are

>>>>>>>>> sold the same way they were bought. Sometimes this do not impact the tax

>>>>>>>>> rate, but do impact the tax codes we need to use to fill eInvoicing,

>>>>>>>>> sometimes it affects both. For instance, in Brazil if I buy an imported

>>>>>>>>> product from a distributor, the goods I purchased from that distributor

>>>>>>>>> will use a specific CST code, but if I import it myself I will have to sell

>>>>>>>>> them with another CST code. In a few cases even the tax rate changes. For a

>>>>>>>>> company like mine, we sometimes buy locally, sometimes import and this kind

>>>>>>>>> of "lot-number-like" control is very difficult to handle without an ERP

>>>>>>>>> system. Our localization still can't handle this.

>>>>>>>>>

>>>>>>>>> Think about it and check if in your country you do not have

>>>>>>>>> cases where you need info from order.line (or even just the order itself),

>>>>>>>>> and/or if you need to do the lot-number-like tracking I mentioned in some

>>>>>>>>> cases. Of course, these two last items account for a smaller % of total

>>>>>>>>> transactions in my country, but they are relevant for a large number of

>>>>>>>>> organizations (they happen often enough that one wishes it were handled by

>>>>>>>>> their ERP system).

>>>>>>>>>

>>>>>>>>> *A few more things to consider before you get your hands dirt:*

>>>>>>>>>

>>>>>>>>> - As far as I know, today the tax calculation does not work well

>>>>>>>>> as an independent tax-engine. Therefore, it is hard to make Odoo provide

>>>>>>>>> the sales agent a table like the one below (showing taxes as a function of

>>>>>>>>> sale location). This is useful for companies that are trying to optimize

>>>>>>>>> their taxation, avoiding taxes when possible. Companies usually achieve

>>>>>>>>> this by setting up factories or branches in special tax locations so it is

>>>>>>>>> interesting if the system can be made easy to offer tax simulations like I

>>>>>>>>> show in the table below, so that a sales agent can place the order in the

>>>>>>>>> best possible way.

>>>>>>>>>

>>>>>>>>> Product Cost Tax A Tax B Tax C

>>>>>>>>> Total

>>>>>>>>>

>>>>>>>>> Location A X X X X X

>>>>>>>>>

>>>>>>>>> Location B X X X X X

>>>>>>>>>

>>>>>>>>> - At least in Brazil, taxes have an hierarchy. Taxes must be

>>>>>>>>> calculated on top of a base value. Such base value sometimes is the value

>>>>>>>>> of the goods being sold but sometimes, for some taxes, it is the value of

>>>>>>>>> the goods PLUS the value of another tax (so tax applies over other tax, in

>>>>>>>>> cascading style). Maybe this is an exclusivity of the crazy Brazilian tax

>>>>>>>>> legislation, maybe not, but one needs to consider it for the tax engine to

>>>>>>>>> work well.

>>>>>>>>>

>>>>>>>>> - Taxes may or may not be part of the product price. In Brazil

>>>>>>>>> usually the price list is inclusive of some taxes so the total price to be

>>>>>>>>> paid by the client will not change if some taxes (that are included in the

>>>>>>>>> price) change;

>>>>>>>>>

>>>>>>>>> - It would be wise if the system had three fields for each tax

>>>>>>>>> rate:

>>>>>>>>> (a) tax_rate_for_display: the tax rate % used for display purposes;

>>>>>>>>> (b) tax_rate_for_invoice_calculation: the tax rate % used for

>>>>>>>>> calculating the tax used for invoicing;

>>>>>>>>> (c) tax_rate_for_effective_payment: the tax rate % that will

>>>>>>>>> actually be paid to the government

>>>>>>>>>

>>>>>>>>> Usually a=b=c, but not ALWAYS!

>>>>>>>>>

>>>>>>>>> (b) is for when you have a tax that is not applied in the usual

>>>>>>>>> TAX_AMOUNT=BASE_VALUE*TAX_RATE way. Hence you need to convert the way the

>>>>>>>>> tax must actually be calculated so that it will work when calculated in the

>>>>>>>>> standard TAX_AMOUNT=BASE_VALUE*TAX_RATE. We have one such case in Brazil,

>>>>>>>>> where the tax called ICMS must be calculated in a way that the tax_rate is

>>>>>>>>> applied over the value of the goods PLUS the value of the ICMS tax itself!

>>>>>>>>> Yes, the tax applies over itself (this is usually the AHA moment, when

>>>>>>>>> foreigners realize how fucked up our tax system is in Brazil). So ICMS has

>>>>>>>>> a tax rate of 25%,18%,17%,12%,7%,4% or 0% depending on a number of

>>>>>>>>> variables. When you need to print the tax rate applied you must write 18%,

>>>>>>>>> but the tax rate you actually use to calculate the tax is given by the

>>>>>>>>> formula TAX_AMOUNT = BASE_VALUE * [1/(1-TAX_RATE)-1]. Hence the need for

>>>>>>>>> the field (b) tax_rate_for_invoice_calculation, one would write (a) = 0.18,

>>>>>>>>> (b) = 0.21951219512 in this example.

>>>>>>>>>

>>>>>>>>> (c) is for when a company has a tax incentive that is not

>>>>>>>>> reflected on the invoices (which is very often in Brazil). So for instance,

>>>>>>>>> I may have a tax break and instead of paying 10% tax I effectively pay only

>>>>>>>>> 5%. But the government still requires me to issue my eInvoices with the 10%

>>>>>>>>> rate like everyone else and I am given a rebate at the end of the month. So

>>>>>>>>> for accounting purposes, in this example we would have (b) = 0.10, (c)

>>>>>>>>> =0.05.

>>>>>>>>>

>>>>>>>>> So one can actually have a situation where all three

>>>>>>>>> fields are different. Not sure you have a similar case in Colombia.

>>>>>>>>>

>>>>>>>>> I wanted to point out all these use cases so that if there

>>>>>>>>> is a coordinated effort to standardize across the "tax calculation engine"

>>>>>>>>> some of these items could be taken into account (not all of them I am

>>>>>>>>> sure).

>>>>>>>>>

>>>>>>>>> Best regards,

>>>>>>>>>

>>>>>>>>> Marcelo

>>>>>>>>> On 2 Jun 2014 02:54, "David Arnold - El Alemán" <david@xxxxxxxxxxx>

>>>>>>>>> wrote:

>>>>>>>>>

>>>>>>>>>> *Hello Raphael*

>>>>>>>>>>

>>>>>>>>>> we are going forth with Colombia following your example.

>>>>>>>>>>

>>>>>>>>>> At this stage I already can make my comments on the logic of the

>>>>>>>>>> mentioned set of modules, as they do not (yet) solve our problem, as

>>>>>>>>>> initially stated.

>>>>>>>>>>

>>>>>>>>>> Lets rename some of the concepts as mapped hereafter for better

>>>>>>>>>> understanding (speaking names at the right abstraction level):

>>>>>>>>>> fiscal position = replecement set (this is historically, but

>>>>>>>>>> wrongly, directly attached to the partner, because it can be equally

>>>>>>>>>> dependent on product caracteristics)

>>>>>>>>>> fiscal classification = fiscal attribute of product

>>>>>>>>>> fiscal position rule = replacement table controller

>>>>>>>>>>

>>>>>>>>>> So what we are missing, and what you missed in barzilian

>>>>>>>>>> localization is a custom "fiscal attribute of partner", which then is taken

>>>>>>>>>> by the "replacement table controller" and funneled into the application of

>>>>>>>>>> a "replecement set" in the very moment that all relvant factors (fiscal

>>>>>>>>>> attributes of product, and fiscal attributes of partner) are available.

>>>>>>>>>>

>>>>>>>>>> So we would have:

>>>>>>>>>> "replacement sets", which are controlled by the "replacement

>>>>>>>>>> table controller", which draws on "fiscal attributes of products" and

>>>>>>>>>> "fiscal attributes of partners" to determin the application of such sets.

>>>>>>>>>>

>>>>>>>>>> Now given, that in south american countries there are various

>>>>>>>>>> fiscal concepts which - in the case of colombia - amount to 8 different

>>>>>>>>>> taxation concepts on a product (retentions included). This being said, in

>>>>>>>>>> the world of a one dimensional application of attributes (product and

>>>>>>>>>> partner) and sets, this actually amounts to the statistical combination of

>>>>>>>>>> cases in each concept (tax) domain. Lets say illustratively

>>>>>>>>>> 5x2x4x5x12x5x8=96000 combinations. This is not the way to go! What we need

>>>>>>>>>> therefore is a flexibilisation by using the already built in tax domain

>>>>>>>>>> concept to gather taxes arround a specific domain - say VAT.

>>>>>>>>>>

>>>>>>>>>> So the idea is, that partner and product each get an attribute

>>>>>>>>>> per every domain. (So if there are 8 domains, a partner or a product can

>>>>>>>>>> have 8 respective attributes) And that each set of attributes is processed

>>>>>>>>>> by the replacement table controller to allocate a flexible set of

>>>>>>>>>> replacement tables, which are executed according to a specified sequence.

>>>>>>>>>>

>>>>>>>>>> Even the creation of Tax domains, and the definition of domain

>>>>>>>>>> items in the respective tables should be dynamic, allowing for further

>>>>>>>>>> flexibilisation.

>>>>>>>>>>

>>>>>>>>>> I think even some concepts of brazilian tax structure have some

>>>>>>>>>> more generic cousins that you might have thought at the time of

>>>>>>>>>> programming. (but honestly, that's just an educated guess)

>>>>>>>>>>

>>>>>>>>>> As leagel requirements in many jurisdiction, I think this should

>>>>>>>>>> go into core as "advanced taxes" some day...

>>>>>>>>>>

>>>>>>>>>> *How is the situation in Thailand about those topics? Seems that

>>>>>>>>>> Thailand is quite similar to Colombia.*

>>>>>>>>>>

>>>>>>>>>> *Nhomar,* have you checked the brazilian concepts? Might there

>>>>>>>>>> be room for convergence with venezuela and mexico? (maybe appling the above

>>>>>>>>>> said)

>>>>>>>>>>

>>>>>>>>>> When we start to override, where should we merge the generic

>>>>>>>>>> portions of code? I'd like to see that built in into the relevant Akretion

>>>>>>>>>> modules...

>>>>>>>>>>

>>>>>>>>>> *Best*, David

>>>>>>>>>>

>>>>>>>>>>

>>>>>>>>>>

>>>>>>>>>>

>>>>>>>>>>

>>>>>>>>>> ----------------------

>>>>>>>>>> *David Arnold B.A. HSG*

>>>>>>>>>> *Gerente*

>>>>>>>>>>

>>>>>>>>>> +57 315 304 1368

>>>>>>>>>> david@xxxxxxxxxxx

>>>>>>>>>> www.elaleman.co

>>>>>>>>>>

>>>>>>>>>> El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

>>>>>>>>>>

>>>>>>>>>>

>>>>>>>>>> 2014-05-29 9:10 GMT-05:00 Raphael Valyi <rvalyi@xxxxxxxxx>:

>>>>>>>>>>

>>>>>>>>>>> Hello David,

>>>>>>>>>>>

>>>>>>>>>>> double check but this OCA project may help you:

>>>>>>>>>>> https://launchpad.net/openerp-fiscal-rules

>>>>>>>>>>> And this is how we override it for Brazil for instance:

>>>>>>>>>>>

>>>>>>>>>>> https://github.com/openerpbrasil/l10n_br_core/blob/develop/l10n_br_account/account_fiscal_position_rule.py

>>>>>>>>>>>

>>>>>>>>>>> as far as I know this is also used in international commerce in

>>>>>>>>>>> Europe, in Canada and may be Italy or Spain.

>>>>>>>>>>>

>>>>>>>>>>> The idea is that the partner don't carry the fiscal position

>>>>>>>>>>> anymore exactly but instead we have that extensible intermediary flat

>>>>>>>>>>> decision table that will determine, depending on many extensible parameters

>>>>>>>>>>> (countries, states, fiscal types etc..) which fiscal position will apply

>>>>>>>>>>> exactly. That table can be large eventually.

>>>>>>>>>>>

>>>>>>>>>>> I think there is room to improve thee compatibility of these

>>>>>>>>>>> module for v8 using the new OCA web_context_tunnel module to avoid creating

>>>>>>>>>>> signature incompatibilities with existing on_changes until the new API will

>>>>>>>>>>> be used everywhere in the addons (probably v9 only).

>>>>>>>>>>>

>>>>>>>>>>> Please let us know if these modules can help you.

>>>>>>>>>>>

>>>>>>>>>>>

>>>>>>>>>>> Regards.

>>>>>>>>>>>

>>>>>>>>>>> --

>>>>>>>>>>> Raphaël Valyi

>>>>>>>>>>> Founder and consultant

>>>>>>>>>>> http://twitter.com/rvalyi <http://twitter.com/#!/rvalyi>

>>>>>>>>>>> +55 21 3942-2434

>>>>>>>>>>> www.akretion.com

>>>>>>>>>>>

>>>>>>>>>>>

>>>>>>>>>>>

>>>>>>>>>>>

>>>>>>>>>>>

>>>>>>>>>>> On Thu, May 29, 2014 at 9:50 AM, David Arnold - El Alemán <

>>>>>>>>>>> david@xxxxxxxxxxx> wrote:

>>>>>>>>>>>

>>>>>>>>>>>> *Hello Fellows*

>>>>>>>>>>>>

>>>>>>>>>>>> in Colombia we (some) are trying to adapt to local

>>>>>>>>>>>> legislations by following a concept of introducing multiple fiscal

>>>>>>>>>>>> positions per parnter. This sould only involve quite minimal code change,

>>>>>>>>>>>> maybe same 30-50 lines of code in total...

>>>>>>>>>>>>

>>>>>>>>>>>> The idea is to cluster fiscal positions under certain domains

>>>>>>>>>>>> (such as one tax1, tax2, tax3, tax4, tax5, etc.) and to be able to assing

>>>>>>>>>>>> to a partner an infinite number of fiscal postiones ordered by domains.

>>>>>>>>>>>>

>>>>>>>>>>>> If we don't introduce this multidimensionality of fiscal

>>>>>>>>>>>> postitons, we would have to multiply out (is this the corect term?) the

>>>>>>>>>>>> matrix and get some 5x5x5x5 (=4 domains with 5 cases each) fiscal

>>>>>>>>>>>> positions... Not cool.

>>>>>>>>>>>>

>>>>>>>>>>>> Would this be a feature eligible for core aknowledging it's

>>>>>>>>>>>> very small code impact (using existing concepts) and its usefullness in

>>>>>>>>>>>> more complicated jurisdictions worldwide?

>>>>>>>>>>>>

>>>>>>>>>>>> Point two, is there some kind of classification flield on

>>>>>>>>>>>> product known, which can serve to prepare for granularity when it comes to

>>>>>>>>>>>> concepts such as BI and XBRL. We would like to link taxes and reporting

>>>>>>>>>>>> requirements to such product classification fields here in colombia. (there

>>>>>>>>>>>> are about 5000-6000 thousend different concepts of municipality tax,

>>>>>>>>>>>> differing from municipality to municipality - which are based on such a

>>>>>>>>>>>> product - or "activity " - classification)

>>>>>>>>>>>>

>>>>>>>>>>>>

>>>>>>>>>>>> *Freundliche Grüsse*

>>>>>>>>>>>>

>>>>>>>>>>>>

>>>>>>>>>>>> ----------------------

>>>>>>>>>>>> *David Arnold B.A. HSG*

>>>>>>>>>>>> *Gerente*

>>>>>>>>>>>>

>>>>>>>>>>>> +57 315 304 1368

>>>>>>>>>>>> david@xxxxxxxxxxx

>>>>>>>>>>>> www.elaleman.co

>>>>>>>>>>>>

>>>>>>>>>>>> El Alemán S.A.S, Carrera 13 # 93 - 40 P4, Bogotá D.C, Colombia

>>>>>>>>>>>>

>>>>>>>>>>>> _______________________________________________

>>>>>>>>>>>> Mailing list: https://launchpad.net/~openerp-community

>>>>>>>>>>>> Post to : openerp-community@xxxxxxxxxxxxxxxxxxx

>>>>>>>>>>>> Unsubscribe : https://launchpad.net/~openerp-community

>>>>>>>>>>>> More help : https://help.launchpad.net/ListHelp

>>>>>>>>>>>>

>>>>>>>>>>>>

>>>>>>>>>>>

>>>>>>>>>>

>>>>>>>>>> _______________________________________________

>>>>>>>>>> Mailing list: https://launchpad.net/~openerp-community

>>>>>>>>>> Post to : openerp-community@xxxxxxxxxxxxxxxxxxx

>>>>>>>>>> Unsubscribe : https://launchpad.net/~openerp-community

>>>>>>>>>> More help : https://help.launchpad.net/ListHelp

>>>>>>>>>>

>>>>>>>>>>

>>>>>>>>> _______________________________________________

>>>>>>>>> Mailing list: https://launchpad.net/~openerp-community

>>>>>>>>> Post to : openerp-community@xxxxxxxxxxxxxxxxxxx

>>>>>>>>> Unsubscribe : https://launchpad.net/~openerp-community

>>>>>>>>> More help : https://help.launchpad.net/ListHelp

>>>>>>>>>

>>>>>>>>>

>>>>>>>>

>>>>>>>

>>>>>>

>>>>

>>>

>>

>

References

-

Multiple fiscal positions on partners

From: David Arnold - El Alemán, 2014-05-29

-

Re: Multiple fiscal positions on partners

From: Raphael Valyi, 2014-05-29

-

Re: Multiple fiscal positions on partners

From: David Arnold - El Alemán, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: Marcelo Bello, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: Gustavo Adrian Marino, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: David Arnold - El Alemán, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: David Arnold - El Alemán, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: Marcelo Bello, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: David Arnold - El Alemán, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: Gustavo Adrian Marino, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: David Arnold - El Alemán, 2014-06-02

-

Re: Multiple fiscal positions on partners

From: David Arnold - El Alemán, 2014-06-03